A part of the Iowa Forcible Entry and Detainer (FED) statute has been declared unconstitutional by the Iowa Supreme Court. The FED statute is that part of the Iowa Code which sets forth the procedures for eviction. The code section at issue states that residential tenants can be informed of their eviction hearing by certified or restricted certified mail, whether or not the tenant signs a receipt for the notice.

Somehow Iowa legislators decided that just putting something in the mailbox was sufficient to give someone notice that there was going to be a hearing which would determine whether or not someone would be thrown out of their home. The Iowa Supreme Court determined that this is not notice at all. A tenant might not even get notice that the certified mail is waiting for them until after the hearing date. I have never understood why, in Illinois, the sheriff needs to put the documents in someone's hand, but in Iowa landlords were allowed just drop a note in the mail.

Here is the opinion.

Friday, November 20, 2009

Friday, October 23, 2009

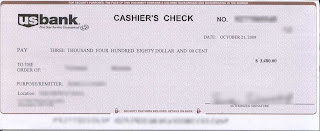

Blue Seal Staffing Scam

Wow, it looks real. We see a lot of certified checks here, and this thing looks REAL. It even does that "VOID" thing in the background when you copy it. Kudos scammers. Except next time, it should say DOLLARS and CENTS, not DOLLAR and CENT. But other than that, top notch, really.

It came in this morning's mail accompanied by a letter from my new bestest friends at Blue Seal Staffing in North Carolina. But strangely the letter came from Canada. Good day, eh? I have been selected to be a mystery shopper! So, here is what I am supposed to do:

1. Deposit the $3,480.

2. Keep $300 for my first week's pay!

3. "Evaluate" Money Gram or Western Union by sending $2,900 to one of Blue Seal Staffing's training agents. Why we couldn't evaluate them for $29 is indeed a good question, and one that will be answered in a moment.

4. Pay the transfer fees of $180.

5. Go buy $100 worth of merchandise at one of several retailers, ostensibly evaluating their service. And I get to keep the merchandise!

That sounds just great, eh? They even did their math correctly. If I do good, I might even get a raise!

Here is what is really going to happen if I went along with this scam. I would deposit the check in my account. Since it is a cashier's check, the funds will probably be available in three days or less. I "keep" my $300.00. I send their "training agent" $2,900. I pay Western Union $180 (does it really cost that much to send money via Western Union? Yowza.) I spend the other $100 on trinkets at any local retailer. Since I want that big raise they promised me, I will send Blue Seal Staffing the forms with all of my personal information. By the time that cashier's check wends through the byzantine maze of banks, I will have spent $3,180. Then my bank will tell me that the check was a forgery, and I get to cover that money I sent.

Well, I thought I would try something different and contact the local authorities to see if they would like to have fun with these folks.

Wednesday, September 30, 2009

Are you kidding me?

An attorney in Somerville, Massechu, Masatchus, Massechuset, Massachusetts came up with a new one. He kept getting new mortgages without paying off his old ones. It appears he had four mortgages on one property, three on another, two on another. These were not second or home equity mortgages. He was directed by the lenders to pay off the previous mortgages. He just didn't. Apparently he kept the money for his own purposes. It took some time for the lenders to catch on, since it was making his payments on time. It took a Fannie Mae database search to uncover the frauds. He failed to disclose some of these additional loans on his loan applications. They even got the Postal Inspector in on this one. He plead guilty to eight counts of Larceny and seven counts of Willfully Making a False Statement Regarding Financial Condition or Assets.

Doesn't it seem to be pretty simple math that making QUADRUPLE house payments eventually is going to catch up to you?

Doesn't it seem to be pretty simple math that making QUADRUPLE house payments eventually is going to catch up to you?

Georgia Attorney Disbarred for Mortgage Fraud

The Georgia Supreme Court has disbarred a Georgia attorney for mortgage fraud. According to the opinion:

"The complaint in S09Y0485 is based upon Moore’s service in June 2006 as the closing attorney for a real estate transaction. At closing, the HUD-1 settlement statement listed a sales price $9,000 higher than the price listed on the sales contract. The settlement statement also listed “cash to seller” of $16,329.84. Of this amount, the seller received $8,079.84 through a wire transfer and Moore wrote a check to the seller for the balance, but gave the check to the buyer’s loan officer. The check has two endorsements, the first from the seller, which the seller’s wife contends is a forgery, and the second from a third person who purportedly loaned money to the buyer to cover the buyer’s down payment."

Sound familiar? You might think, well heck, maybe this poor guy had no idea that the money wasn't going to the seller, but there are enough red flags here to start a Chinese marching band. Why didn't the purchase price match the purchase agreement? He wired part of the money directly to the seller. Shouldn't he question why he wasn't wiring the full amount to the seller? Why did he give the check to the buyer's loan officer. Wouldn't it be more appropriate to give it to a representative of the seller, if not the seller himself? When these kind of things come up at closing, the closing agent and the attorneys have a duty to ask questions.

www.thomasmoens.com

"The complaint in S09Y0485 is based upon Moore’s service in June 2006 as the closing attorney for a real estate transaction. At closing, the HUD-1 settlement statement listed a sales price $9,000 higher than the price listed on the sales contract. The settlement statement also listed “cash to seller” of $16,329.84. Of this amount, the seller received $8,079.84 through a wire transfer and Moore wrote a check to the seller for the balance, but gave the check to the buyer’s loan officer. The check has two endorsements, the first from the seller, which the seller’s wife contends is a forgery, and the second from a third person who purportedly loaned money to the buyer to cover the buyer’s down payment."

Sound familiar? You might think, well heck, maybe this poor guy had no idea that the money wasn't going to the seller, but there are enough red flags here to start a Chinese marching band. Why didn't the purchase price match the purchase agreement? He wired part of the money directly to the seller. Shouldn't he question why he wasn't wiring the full amount to the seller? Why did he give the check to the buyer's loan officer. Wouldn't it be more appropriate to give it to a representative of the seller, if not the seller himself? When these kind of things come up at closing, the closing agent and the attorneys have a duty to ask questions.

www.thomasmoens.com

Thursday, August 27, 2009

(More) Something local

Two more players have been indicted along with Mary Pat Harper. The buyers who were working with Ms. Harper, Darryl Hanneken and Robert Herdrich, have been indicted on eighteen counts of wire fraud and five counts of bank fraud. Yowza. I have a feeling the US Attorney is not done yet either. According to the indictment, the above-referenced frauds were perpetrated by Mssrs. Hanneken and Herdrich (H&H) "and others." Note: that's "others," plural. Particularly interesting is Paragraph 7 of the that part of the indictment entitled "The Scheme" which says:

"It was further part of the scheme

that HANNEKEN and HERDRICH,

along with the real estate agents,

mortgage brokers, and attorneys,

intentionally concealed from each

financial institution or mortgage

lender the existence of the lower

actual price and the kickback."

In case you haven't read the previous blog, this is the old dual contract scam. There would be a contract presented to the seller which showed a price well in excess of what the seller actually wanted for the property. A page tacked onto the back of the contract would say that extra money was to be given to the buyer after closing. This extra page was "somehow" removed from the contract when it was presented to the lender. This is bad because the lender doesn't know how much the purchase price actually is.

For example, if you agree to buy my pen for $100 (hey, I have cool pens--I make them myself), but I am going to give you $50 back when you buy it, how much did you actually pay for it. Fifty bucks, right? The only thing is, the lender didn't know about that money that was given back to the buyer because that page was missing, and the parties to the transaction didn't put it on the HUD-1 Settlement Statement. And no, that wasn't the buyers' money, it was the lender's, and it was provided for the sole purpose of purchasing the property (especially considering they never even made a payment on some of these properties). This money was not provided to line the buyers' pockets.

Go ahead, read that quoted paragraph again. Yes, they said "attorneys." Did the attorneys know about the fraud? Looks like the US Attorney thinks so. Did they attorneys do anything to stop it? It sure doesn't look like it. Why not!? It is our job to explain the law to our clients. Most of the time, they follow our advice. Granted, we do not have a duty to wrestle them to the ground to stop transactions like this, but it is damn easy to refuse to be involved. I have walked away from a few transactions--it is not difficult at all.

I looked up a few of these transactions to see what kinds of prices and price changes were involved. Here are a few:

Purchased by H&H for $110,000, sold after the foreclosure for $52,000

Purchased by H&H for $125,000, sold after the foreclosure for $50,560

Purchased by H&H for $125,000, sold after the foreclosure for $52,000

Purchased by H&H for $110,000, sold after the foreclosure for $40,000

Purchased by H&H for $115,000, sold after the foreclosure for $34,900

There are 23 properties referenced in the indictment.

"So what," you say. "They done bad and they got caught, so all is well." Not really. Imagine the impact on neighbors of these properties. Appraisers use comparisons of similar properties (called comparables) when they appraise properties. Say you purchased a property in the dizzying heights of the H&H buying spree. H&H bought at least 23 properties in what appears to be a fairly small geographic area. So, now the comparables are skewed by these over-inflated prices--remember the pen analogy--they didn't really pay the price which appears in the public records. You paid too much, because you didn't do any kickbacks under the table at closing. Now you want to sell or refinance. Based on these new prices, we have some new information for our comparables. Same houses, but different prices. Based on the examples above, your house might now be worth almost 40% less than it was just a few years ago. Don't forget that these properties probably have been sitting vacant for months during the foreclosure proceedings. Now aren't you glad the FBI and the US Attorneys office are taking this seriously? I know I am.

I will keep my eye on PACER (the Federal Court system's online access portal) to let you know of any new developments. Please send me a comment if you see anything else on this case, or if there is any other subject you would like to see discussed.

Thanks to Joshua for bringing this one to my attention.

www.thomasmoens.com

"It was further part of the scheme

that HANNEKEN and HERDRICH,

along with the real estate agents,

mortgage brokers, and attorneys,

intentionally concealed from each

financial institution or mortgage

lender the existence of the lower

actual price and the kickback."

In case you haven't read the previous blog, this is the old dual contract scam. There would be a contract presented to the seller which showed a price well in excess of what the seller actually wanted for the property. A page tacked onto the back of the contract would say that extra money was to be given to the buyer after closing. This extra page was "somehow" removed from the contract when it was presented to the lender. This is bad because the lender doesn't know how much the purchase price actually is.

For example, if you agree to buy my pen for $100 (hey, I have cool pens--I make them myself), but I am going to give you $50 back when you buy it, how much did you actually pay for it. Fifty bucks, right? The only thing is, the lender didn't know about that money that was given back to the buyer because that page was missing, and the parties to the transaction didn't put it on the HUD-1 Settlement Statement. And no, that wasn't the buyers' money, it was the lender's, and it was provided for the sole purpose of purchasing the property (especially considering they never even made a payment on some of these properties). This money was not provided to line the buyers' pockets.

Go ahead, read that quoted paragraph again. Yes, they said "attorneys." Did the attorneys know about the fraud? Looks like the US Attorney thinks so. Did they attorneys do anything to stop it? It sure doesn't look like it. Why not!? It is our job to explain the law to our clients. Most of the time, they follow our advice. Granted, we do not have a duty to wrestle them to the ground to stop transactions like this, but it is damn easy to refuse to be involved. I have walked away from a few transactions--it is not difficult at all.

I looked up a few of these transactions to see what kinds of prices and price changes were involved. Here are a few:

Purchased by H&H for $110,000, sold after the foreclosure for $52,000

Purchased by H&H for $125,000, sold after the foreclosure for $50,560

Purchased by H&H for $125,000, sold after the foreclosure for $52,000

Purchased by H&H for $110,000, sold after the foreclosure for $40,000

Purchased by H&H for $115,000, sold after the foreclosure for $34,900

There are 23 properties referenced in the indictment.

"So what," you say. "They done bad and they got caught, so all is well." Not really. Imagine the impact on neighbors of these properties. Appraisers use comparisons of similar properties (called comparables) when they appraise properties. Say you purchased a property in the dizzying heights of the H&H buying spree. H&H bought at least 23 properties in what appears to be a fairly small geographic area. So, now the comparables are skewed by these over-inflated prices--remember the pen analogy--they didn't really pay the price which appears in the public records. You paid too much, because you didn't do any kickbacks under the table at closing. Now you want to sell or refinance. Based on these new prices, we have some new information for our comparables. Same houses, but different prices. Based on the examples above, your house might now be worth almost 40% less than it was just a few years ago. Don't forget that these properties probably have been sitting vacant for months during the foreclosure proceedings. Now aren't you glad the FBI and the US Attorneys office are taking this seriously? I know I am.

I will keep my eye on PACER (the Federal Court system's online access portal) to let you know of any new developments. Please send me a comment if you see anything else on this case, or if there is any other subject you would like to see discussed.

Thanks to Joshua for bringing this one to my attention.

www.thomasmoens.com

Wednesday, July 1, 2009

Private cause of action for consumer fraud

A new law just took effect in Iowa which allows private causes of action for consumer fraud. Previously, if a consumer was defrauded, only the Attorney General could bring suit. So basically, if you were defrauded, it was at the sole discretion of the Iowa Attorney General if anything would be done about it. Now, any consumer who is defrauded can bring a lawsuit to make things right. Under the new law, the consumer can be awarded attorneys fees as well as damages up to three times the amount of actual damages.

www.thomasmoens.com

www.thomasmoens.com

Septic Inspections in Iowa

As of today, if you have a septic system in Iowa, you will need to pump it and have it inspected before you sell the property. There are a few exceptions, but if it is a regular old sale of residential real estate, you are going to need a "time of transfer inspection." And not just any inspector can do these inspections. It has to be a "certified time of transfer inspector who has been certified by the Iowa Department of Natural Resources.

It appears there are fewer than 250 inspectors for the entire state of Iowa. With 99 counties, that's only about 2.5 inspectors per county.

The county recorders will not record your deed without an inspection report from these special certified inspectors attached to your groundwater hazard statement.

Should be lots of fun for a while.

www.thomasmoens.com

It appears there are fewer than 250 inspectors for the entire state of Iowa. With 99 counties, that's only about 2.5 inspectors per county.

The county recorders will not record your deed without an inspection report from these special certified inspectors attached to your groundwater hazard statement.

Should be lots of fun for a while.

www.thomasmoens.com

Friday, June 19, 2009

Something local

Mary Pat Harper, formerly Mary Pat Lord was indicted in the U.S. District Court for seven counts of wire fraud. Look through my previous posts and see if I do not deserve an award for not saying, "I told you so."

Ms. Harper was a real estate agent in the Quad City area. Her license is "expired" according to licensediniowa.gov. Ms. Harper represented two individuals, Robert Herdrich and Darryl Hanneken, who purchased numerous properties in the Americana Park subdivision in northwest Davenport. Here is how the scheme worked: The two purchasers would agree to buy a house for a certain price, say for example, $140,000. Ms. Harper, who apparently prepared the purchase agreements, would attach an addendum which stated that the buyers would receive $40,000 back from the seller at closing. Essentially, the seller would be receiving $100,000 for the property ($140,000 minus the $40,000 the seller would give to the buyer at closing). Ms. Harper would fax the purchase agreement to the mortgage broker, but somehow the addendum would not be attached by the time it got to the actual lender. Because of this omission, the lender would be under the impression that the purchase price was $140,000 with no credit back to the buyer. The $40,000 would not appear on the settlement statement, so the lender would have no way of knowing that the buyers were not actually paying the full $140,000 for the property.

She did this at least seven times according to the indictment. Then the buyers stopped making their payments. Then the properties were foreclosed. Then likely you and I bailed someone out, the properties sat empty and deteriorated, and property values went down.

So, buyers, sellers, real estate agents, real estate brokers, closing agents, appraisers, and especially attorneys take note: If it is not on the settlement statement, it does not happen. If you do prepare or sign a settlement statement that does not accurately reflect all receipts and disbursements, look for nice folks in dark suits and black SUVs to stop by your office. Soon.

See, I never once said, "I told you so" in this whole, entire blog.

Thank you FBI and U.S. Attorneys! Keep up the good work.

www.thomasmoens.com

Ms. Harper was a real estate agent in the Quad City area. Her license is "expired" according to licensediniowa.gov. Ms. Harper represented two individuals, Robert Herdrich and Darryl Hanneken, who purchased numerous properties in the Americana Park subdivision in northwest Davenport. Here is how the scheme worked: The two purchasers would agree to buy a house for a certain price, say for example, $140,000. Ms. Harper, who apparently prepared the purchase agreements, would attach an addendum which stated that the buyers would receive $40,000 back from the seller at closing. Essentially, the seller would be receiving $100,000 for the property ($140,000 minus the $40,000 the seller would give to the buyer at closing). Ms. Harper would fax the purchase agreement to the mortgage broker, but somehow the addendum would not be attached by the time it got to the actual lender. Because of this omission, the lender would be under the impression that the purchase price was $140,000 with no credit back to the buyer. The $40,000 would not appear on the settlement statement, so the lender would have no way of knowing that the buyers were not actually paying the full $140,000 for the property.

She did this at least seven times according to the indictment. Then the buyers stopped making their payments. Then the properties were foreclosed. Then likely you and I bailed someone out, the properties sat empty and deteriorated, and property values went down.

So, buyers, sellers, real estate agents, real estate brokers, closing agents, appraisers, and especially attorneys take note: If it is not on the settlement statement, it does not happen. If you do prepare or sign a settlement statement that does not accurately reflect all receipts and disbursements, look for nice folks in dark suits and black SUVs to stop by your office. Soon.

See, I never once said, "I told you so" in this whole, entire blog.

Thank you FBI and U.S. Attorneys! Keep up the good work.

www.thomasmoens.com

Friday, May 1, 2009

Notary jail!

Not quite, but close. An appellate court in Illinois has clarified that employers are responsible for the acts of their notary employees, and the court seems to be saying that employers are obligated to train their employees adequately. It is certainly a good idea to make sure your notary employees are properly trained (we do), but it is not specifically required by statute. This is an important case if you have any notaries on your staff who notarize documents "on the clock."

The case was rather fact-intensive (seventy-two pages worth), but for a very short version: The case involved a Kinko's employee who either notarized a document without adequate verification of identity, allowed someone else to use his notary stamp, or notarized a document without the signer present. Based on this defective notarization, a $100,000+ fraud was perpetrated.

Kinko's provided training, but the trainer was not a notary or attorney, the materials he prepared were not prepared or reviewed by a notary or attorney, and he did not test the employees in any way. Based on his training, the notary was under the impression that all he needed to do was match the signature on any sort of identification provided by the signer to the signature on the document he was notarizing. He did nothing to otherwise verify the identity of individuals whose signatures he notarized. He left his notary stamp somewhat unsecured, and his story is that he left his notary stamp with Kinko's when he moved on to another location.

Sure there are a lot of jokes about notary jail, and notary school, and notary police, implying that being a notary is a simple and and ministerial function. In reality, a notary is a public official, and as such has important duties to others who rely on the documents he or she acknowledges.

We would be happy to provide assistance or training to any employer which has notaries on its staff. It could save you $100,000+.

The case was rather fact-intensive (seventy-two pages worth), but for a very short version: The case involved a Kinko's employee who either notarized a document without adequate verification of identity, allowed someone else to use his notary stamp, or notarized a document without the signer present. Based on this defective notarization, a $100,000+ fraud was perpetrated.

Kinko's provided training, but the trainer was not a notary or attorney, the materials he prepared were not prepared or reviewed by a notary or attorney, and he did not test the employees in any way. Based on his training, the notary was under the impression that all he needed to do was match the signature on any sort of identification provided by the signer to the signature on the document he was notarizing. He did nothing to otherwise verify the identity of individuals whose signatures he notarized. He left his notary stamp somewhat unsecured, and his story is that he left his notary stamp with Kinko's when he moved on to another location.

Sure there are a lot of jokes about notary jail, and notary school, and notary police, implying that being a notary is a simple and and ministerial function. In reality, a notary is a public official, and as such has important duties to others who rely on the documents he or she acknowledges.

We would be happy to provide assistance or training to any employer which has notaries on its staff. It could save you $100,000+.

Thursday, April 23, 2009

Illinois Corporate Compliance

A new scam! Apparently these folks took a page from Illinois Deed Provider's playbook. Illinois Corporate Compliance contacts corporations to inform them that for a fee of $150, they will file your corporate minutes with the State.

You do not need to file your corporate minutes with the State in Illinois. And as far as I know, even if you wanted to file your minutes with the State, you could not do so. There is no reason to do this, and there is no fee from the State to file minutes. You do need to file your annual report along with a fee, but that fee goes directly to the Illinois Secretary of State.

It IS very important for Illinois corporations to prepare their annual minutes, but they need to go in your minute book, not filed with the State. This can be difficult to remember to do unless you have an attorney prepare them for you every year. Most of our corporate clients have us act as their registered agent, so each year, when the annual report is due, we make sure their "corporate house" is in order by preparing minutes, and assisting with filing the annual report.

Always be on the lookout for private companies trying to pretend to be part of the government.

You do not need to file your corporate minutes with the State in Illinois. And as far as I know, even if you wanted to file your minutes with the State, you could not do so. There is no reason to do this, and there is no fee from the State to file minutes. You do need to file your annual report along with a fee, but that fee goes directly to the Illinois Secretary of State.

It IS very important for Illinois corporations to prepare their annual minutes, but they need to go in your minute book, not filed with the State. This can be difficult to remember to do unless you have an attorney prepare them for you every year. Most of our corporate clients have us act as their registered agent, so each year, when the annual report is due, we make sure their "corporate house" is in order by preparing minutes, and assisting with filing the annual report.

Always be on the lookout for private companies trying to pretend to be part of the government.

Labels:

corporation,

illinois corporate compliance,

scam

Wednesday, March 25, 2009

Lien filing service?

Huh? Lien filing service? How is this happening? Apparently contractors are paying firms (NOT law firms) to file mechanic's liens for them. The Illinois Attorney General is getting after one of these firms:

According to the Attorney General’s complaint, Contractor’s Lien Services (CLS) and its founder, Steve Boucher, analyze, prepare and file mechanic’s liens on property on behalf of general contractors and subcontractors. CLS allegedly misrepresents to contractors that it has valid cause for filing mechanics liens against homeowners when, most often, those contractors do not actually have valid claims under state laws. CLS also allegedly files liens without the knowledge of some contractors and, in other instances, CLS files liens against homeowners when contractors have not performed work at the properties in question.

After filing foreclosure liens, CLS allegedly files foreclosure actions against consumers who don’t pay off the debts. Some contractors claim that CLS collects money on behalf of contractors but then fails to redistribute the collected debts to them.

The press release does not refer to any unauthorized practice of law claims, which seems like a slam dunk. While filing a mechanic's lien is easy-peasy, the mechanic's lien law is rather complex. Filing it amounts to filling out a simple form and giving the recorder's office $40 or $50. There is no need to pay someone to do that. Knowing when to file one and in what circumstances is where the knowlege and expertise comes into play. If this CLS was giving this kind of advice, they were 1) giving wrong advice, and 2) engaging in the unauthorized practice of law. Either way, all they are allowed by law to do is file a form you complete at the recorder's office. If they were charging more than fifty cents, the contractors were paying too much, since all you need to do is mail it with your filing fee check to the recorder.

File a lien when you should not, and you could be looking at your lien being invalid at best, or defending a slander of title lawsuit at worst. I have no idea how much this CLS outfit charged contractors, but mechanic's lien law is not the place to skimp. Hire an attorney who knows mechanic's lien law.

The press release goes on to describe how many homeowners were duped into paying off liens which were wholly invalid, sometimes when they did not even have any work done by the contractors whose names were on the liens. Just because someone files a lien against your home does not necessarily mean you owe them money or that you need to pay them. If you believe there is a valid reason you do not owe the money they claim (whether it is because the contractor did not do all the work claimed, did it badly, did not do it at all, you already paid them, the lien was filed too late, etc., etc., etc.), talk to an attorney before you pony up the cash.

www.thomasmoens.com

According to the Attorney General’s complaint, Contractor’s Lien Services (CLS) and its founder, Steve Boucher, analyze, prepare and file mechanic’s liens on property on behalf of general contractors and subcontractors. CLS allegedly misrepresents to contractors that it has valid cause for filing mechanics liens against homeowners when, most often, those contractors do not actually have valid claims under state laws. CLS also allegedly files liens without the knowledge of some contractors and, in other instances, CLS files liens against homeowners when contractors have not performed work at the properties in question.

After filing foreclosure liens, CLS allegedly files foreclosure actions against consumers who don’t pay off the debts. Some contractors claim that CLS collects money on behalf of contractors but then fails to redistribute the collected debts to them.

The press release does not refer to any unauthorized practice of law claims, which seems like a slam dunk. While filing a mechanic's lien is easy-peasy, the mechanic's lien law is rather complex. Filing it amounts to filling out a simple form and giving the recorder's office $40 or $50. There is no need to pay someone to do that. Knowing when to file one and in what circumstances is where the knowlege and expertise comes into play. If this CLS was giving this kind of advice, they were 1) giving wrong advice, and 2) engaging in the unauthorized practice of law. Either way, all they are allowed by law to do is file a form you complete at the recorder's office. If they were charging more than fifty cents, the contractors were paying too much, since all you need to do is mail it with your filing fee check to the recorder.

File a lien when you should not, and you could be looking at your lien being invalid at best, or defending a slander of title lawsuit at worst. I have no idea how much this CLS outfit charged contractors, but mechanic's lien law is not the place to skimp. Hire an attorney who knows mechanic's lien law.

The press release goes on to describe how many homeowners were duped into paying off liens which were wholly invalid, sometimes when they did not even have any work done by the contractors whose names were on the liens. Just because someone files a lien against your home does not necessarily mean you owe them money or that you need to pay them. If you believe there is a valid reason you do not owe the money they claim (whether it is because the contractor did not do all the work claimed, did it badly, did not do it at all, you already paid them, the lien was filed too late, etc., etc., etc.), talk to an attorney before you pony up the cash.

www.thomasmoens.com

Wednesday, March 4, 2009

Interesting stats

I have been tracking lender's bid vs. sale price for FHA loans in Iowa for a little while, and the numbers are interesting.

The calculation:

The sale price to a new buyer after the sheriff's sale divided by the amount bid by the lender at the sheriff's sale as a percentage.

The data:

The amount bid by the lender at the sheriff's sale is essentially the money the lender has lost, between the principal balance of the loan, accrued interest, taxes and insurance paid by the lender, and costs of the foreclosure. The sale price to a new buyer is the actual price paid by someone who is buying the property after the foreclosure has gone through and the property has gone back on the market.

The results:

The price paid by the new buyer is a little more than half of what the lender bid at the sheriff's sale. For seventy-six properties analyzed, the drop is 48.28%. There were some amazing outlyers:

$58,000 bid - $8,000 sales price

$44,000 bid - $5,000 sales price

$45,000 bid - $3,000 sales price

$80,000 bid - $21,000 sales price

$115,000 bid - $42,000 sales price

The average number of days between the sheriff's sale and the date of the accepted contract is 291--sneaking up on a year. This does not include the time it takes to foreclose, which can be an additional two to twelve months.

Granted, this is a relatively small sample (however, the standard deviation is 0.1656, so the difference is certainly statistically significant), but what is the cause of incredible loss of value? Three possibilities come to mind:

The calculation:

The sale price to a new buyer after the sheriff's sale divided by the amount bid by the lender at the sheriff's sale as a percentage.

The data:

The amount bid by the lender at the sheriff's sale is essentially the money the lender has lost, between the principal balance of the loan, accrued interest, taxes and insurance paid by the lender, and costs of the foreclosure. The sale price to a new buyer is the actual price paid by someone who is buying the property after the foreclosure has gone through and the property has gone back on the market.

The results:

The price paid by the new buyer is a little more than half of what the lender bid at the sheriff's sale. For seventy-six properties analyzed, the drop is 48.28%. There were some amazing outlyers:

$58,000 bid - $8,000 sales price

$44,000 bid - $5,000 sales price

$45,000 bid - $3,000 sales price

$80,000 bid - $21,000 sales price

$115,000 bid - $42,000 sales price

The average number of days between the sheriff's sale and the date of the accepted contract is 291--sneaking up on a year. This does not include the time it takes to foreclose, which can be an additional two to twelve months.

Granted, this is a relatively small sample (however, the standard deviation is 0.1656, so the difference is certainly statistically significant), but what is the cause of incredible loss of value? Three possibilities come to mind:

- The lenders loaned way more than the property was worth;

- The foreclosure process takes too long, and allows the properties to remain vacant for such long period of time that they significantly deteriorate;

- Something about the property being vacant and/or foreclosed somehow stigmatizes the property, and makes many buyers avoid them.

Any other ideas, or better yet, suggestions?

Friday, January 30, 2009

Another attempt

I had to stave off another attempt to commit fraud via a HUD-1 Settlement Statement a few weeks ago. This time I alienated what is apparently the First Centrally located State Bank which is located in Iowa--if you catch my drift.

This was an FHA loan. There was a provision requiring the seller to pay $3,000 of the buyer's closing costs. Prior to closing we received a preliminary HUD-1 from the short-sleeved-dress-shirt-wearing closing agent which accurately showed the $3K as a credit from the seller to the buyer. When we arrived at closing, the seller paid closing cost credit had been reduced to $700. Since this was an FHA loan, the buyer was required to put in 3% of his own money (the closing was in 2008). If he had been given the whole $3K, he would not have met this requirement, so the lender reduced the seller paid closing cost credit.

The buyer reasonably asked how he was going to receive the remainder of his $3K in closing costs. We volunteered that we had no objection to paying the full $3K, but it would have to be shown on the settlement statement. The loan officer jumped in and told me that the seller had to write a check the the buyer for the $2,300 because it was in the purchase agreement. Apparently she was the buyer's attorney too!

Even though this was a state bank, and the loan officer was the one recommending we cut a check under the table, they were acting as a broker, so I am certain the end lender would not accept this. I told her that this was fraud, plain and simple, and I read to her the language from the settlement statement and from the the Certification of Seller in an FHA-Insured Loan Transaction, which says:

I certify that I have not and will not pay or reimburse the borrower(s) for any part of the cash downpayment.

That is when she really got mad. Actually turned red, wouldn't let me get a word in edgewise, tried to stare me down with an evil glare; that sort of mad. I gathered from her reaction that this was not her first "just write a check under the table that will solve everything the lender will never know" rodeo. Mr. Pocket Protector closing agent was not much help either, smugly repeating, "Oh, I'm sure there's something you can do to work this out." When I asked for suggestions, he was not very forthcoming.

I suggested that the purchase price and/or loan amount could be changed to ensure the buyer contributed his required 3%. They would have none of that.

Do you think I went too far when I told the loan officer that it was attitudes and actions like hers that have ruined this country? I thought maybe I had, but honestly, it really didn't seem to bother her.

This was an FHA loan. There was a provision requiring the seller to pay $3,000 of the buyer's closing costs. Prior to closing we received a preliminary HUD-1 from the short-sleeved-dress-shirt-wearing closing agent which accurately showed the $3K as a credit from the seller to the buyer. When we arrived at closing, the seller paid closing cost credit had been reduced to $700. Since this was an FHA loan, the buyer was required to put in 3% of his own money (the closing was in 2008). If he had been given the whole $3K, he would not have met this requirement, so the lender reduced the seller paid closing cost credit.

The buyer reasonably asked how he was going to receive the remainder of his $3K in closing costs. We volunteered that we had no objection to paying the full $3K, but it would have to be shown on the settlement statement. The loan officer jumped in and told me that the seller had to write a check the the buyer for the $2,300 because it was in the purchase agreement. Apparently she was the buyer's attorney too!

Even though this was a state bank, and the loan officer was the one recommending we cut a check under the table, they were acting as a broker, so I am certain the end lender would not accept this. I told her that this was fraud, plain and simple, and I read to her the language from the settlement statement and from the the Certification of Seller in an FHA-Insured Loan Transaction, which says:

I certify that I have not and will not pay or reimburse the borrower(s) for any part of the cash downpayment.

That is when she really got mad. Actually turned red, wouldn't let me get a word in edgewise, tried to stare me down with an evil glare; that sort of mad. I gathered from her reaction that this was not her first "just write a check under the table that will solve everything the lender will never know" rodeo. Mr. Pocket Protector closing agent was not much help either, smugly repeating, "Oh, I'm sure there's something you can do to work this out." When I asked for suggestions, he was not very forthcoming.

I suggested that the purchase price and/or loan amount could be changed to ensure the buyer contributed his required 3%. They would have none of that.

Do you think I went too far when I told the loan officer that it was attitudes and actions like hers that have ruined this country? I thought maybe I had, but honestly, it really didn't seem to bother her.

Wednesday, January 21, 2009

Foreclosure suggestions

Sorry for the lack of entries of late. Somehow Google decided I was in Japan, so everything in blogspot was in Japanese. Google, I assure you that I am not in Japan, and as evidence submit the sub-zero temperatures and mounds of snow outside my window.

First, if you are having difficulties making your payments, contact your lender, and see if you can work something out with them. Document EVERYTHING. Every telephone call, every letter, every statement, every check. Write down who you talked to, what was said, what time it was, what number you called. Keep copies of everything you send to your lender and everything your lender sends to you.

If you or anyone you know is in foreclosure, or even close to foreclosure, I would suggest a consultation with a knowledgable attorney. I have seen some amazingly sloppy and/or fraudulent work on the part of lender, mortgage brokers, closing agents, appraisers, and real estate agents. Some of their sloppy and/or fraudulent work may be a foreclosure defense. I will run through a few examples, but there are so many tricks these folks pull. Even if you do not see anything in this list that you think applies to your situation, there may be something else that a thorough review of your closing documents might reveal. Be sure to refer to my Foreclosure Rescue Scams article.

In Iowa, if a spouse does not sign the mortgage, the mortgage is void. Wells Fargo recently lost big on this one. Married couple owned a home and refinanced with Wells Fargo. Only the husband was on the loan and only the husband signed the mortgage. Judge said the mortgage was void, and Wells Fargo could not foreclose. Yes, that means they could live there forever without making a house payment. Well, they could live there forever without making a payment IF they could live forever, which they probably can't, but you get my point.

For a refinance, each individual must be given two copies of the Notice of Right to Cancel.

For a refinance, if two people own the property, both of them must sign the Notice of Right to Cancel, even if only one of them is on the loan.

For a refinance, the dates on the copies of the Notice of Right to Cancel give to the borrowers must be completed. Often, I have seen where the closing agent fills in the dates on the original signed by the borrowers, but fails to do so on the copies given to the borrowers.

For some reason, many lenders are sloppy about giving required notices of default to borrowers. When a lender forecloses, they must do everything exactly, perfectly right.

Some lenders fail to provide disclosures to you prior to your closing.

Some lenders fail to provide accurate estimates of closing costs prior to your closing.

There is an interesting case brewing on the east coast. Countrywide is arguing that their claims that they are working with people to prevent foreclosure is mere puffery. Read this story, and see if your blood boils as much as mine did. How they are still in "business," if that's what you call it, completely escapes me.

First, if you are having difficulties making your payments, contact your lender, and see if you can work something out with them. Document EVERYTHING. Every telephone call, every letter, every statement, every check. Write down who you talked to, what was said, what time it was, what number you called. Keep copies of everything you send to your lender and everything your lender sends to you.

If you or anyone you know is in foreclosure, or even close to foreclosure, I would suggest a consultation with a knowledgable attorney. I have seen some amazingly sloppy and/or fraudulent work on the part of lender, mortgage brokers, closing agents, appraisers, and real estate agents. Some of their sloppy and/or fraudulent work may be a foreclosure defense. I will run through a few examples, but there are so many tricks these folks pull. Even if you do not see anything in this list that you think applies to your situation, there may be something else that a thorough review of your closing documents might reveal. Be sure to refer to my Foreclosure Rescue Scams article.

In Iowa, if a spouse does not sign the mortgage, the mortgage is void. Wells Fargo recently lost big on this one. Married couple owned a home and refinanced with Wells Fargo. Only the husband was on the loan and only the husband signed the mortgage. Judge said the mortgage was void, and Wells Fargo could not foreclose. Yes, that means they could live there forever without making a house payment. Well, they could live there forever without making a payment IF they could live forever, which they probably can't, but you get my point.

For a refinance, each individual must be given two copies of the Notice of Right to Cancel.

For a refinance, if two people own the property, both of them must sign the Notice of Right to Cancel, even if only one of them is on the loan.

For a refinance, the dates on the copies of the Notice of Right to Cancel give to the borrowers must be completed. Often, I have seen where the closing agent fills in the dates on the original signed by the borrowers, but fails to do so on the copies given to the borrowers.

For some reason, many lenders are sloppy about giving required notices of default to borrowers. When a lender forecloses, they must do everything exactly, perfectly right.

Some lenders fail to provide disclosures to you prior to your closing.

Some lenders fail to provide accurate estimates of closing costs prior to your closing.

There is an interesting case brewing on the east coast. Countrywide is arguing that their claims that they are working with people to prevent foreclosure is mere puffery. Read this story, and see if your blood boils as much as mine did. How they are still in "business," if that's what you call it, completely escapes me.

Subscribe to:

Posts (Atom)